'Focus in on 2000-2001 and 2007-2009.'

Posted by archive

Two of the Most Important Charts to Keep On Your Radar

Long-time readers know I’ve traded the intermediate-term trends in the High Yield Junk Bond market since the early 1990’s. From experience I can share that down trends in HY lead to down trends in the stock market, which lead to down trends in the economy. The really big investment mistakes come during economic recessions, so it is important from a money management perspective to avoid the big dislocations that recessions tend to bring.

This first chart plots the price trend of a large and popular high yield mutual fund. The solid green line is a simple 50-day moving average price line. The idea is to invest when the price trend is up (above the green line) and move to Treasurys or cash when the price trend is down (below the green line). In particular, focus in on 2000-2001 and 2007-2009.

<center><img src="[www.cmgwealth.com]; width="800" height="500"></img>

Source: StockCharts.com</center>

While not all crosses work, a number of false signals, the end result is worth the effort. The most meaningful signals occur when price is far above trend (today’s condition) or far below trend (tomorrow’s next great opportunity).

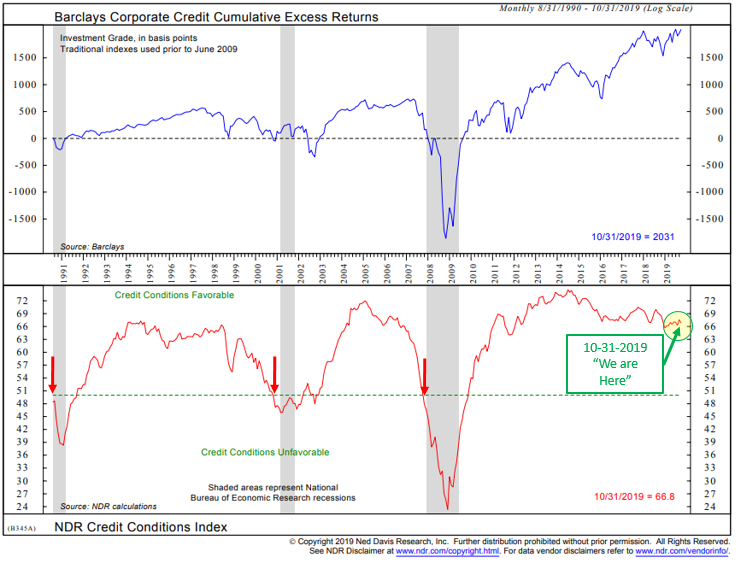

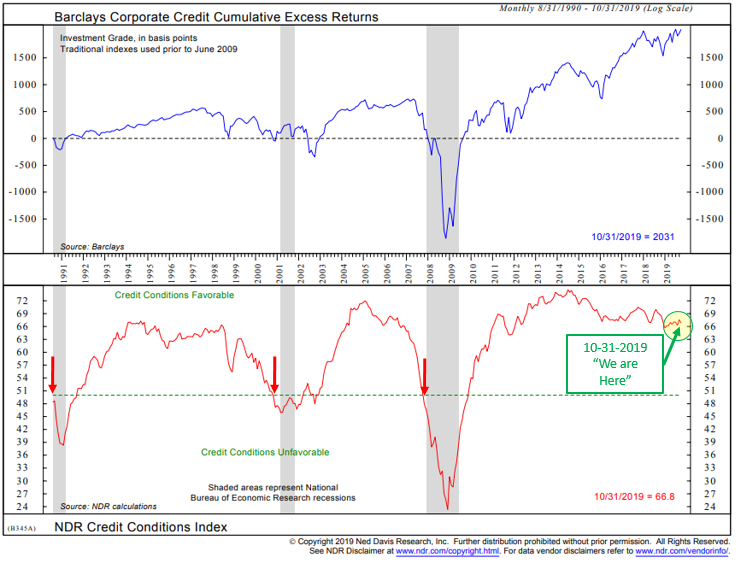

Now, where I think we can really zero in on timing is to combine what price is telling us (above data) with lending conditions. When the lending conditions turn from “Favorable” to “Unfavorable,” that’s when high risk borrowers default. Or as Warren Buffett says, when the tide goes out we’ll see who’s swimming naked. And this time around a lot of swimmers have left their swimsuits on the beach.

Here is how you read the chart:

Note the three red down arrows. They mark the times when the NDR Credit Conditions Index dropped below a reading of 50 (horizontal green dotted line in the lower section of the chart).

- The grey bars indicate periods of recession.

- Finally, note the green “We are Here” arrow.

- Bottom line: Nothing to worry about at this moment.

<center> </center>

</center>

With both HY in an uptrend and lending conditions “Favorable” do go into the weekend with ease and take comfort in knowing there are things you can do to cover your backside.

As you’ll see in the next section, the Trade Signals remain green...'

- Steve Blumenthal, The Slow Squeeze, November 8, 2019

Context

'.."omnipotent central banks" .. create huge distortions..'

Extraordinary Monetary Disorder - 'I have that same uncomfortable feeling I had in 2007 – just a lot worse..'

Long-time readers know I’ve traded the intermediate-term trends in the High Yield Junk Bond market since the early 1990’s. From experience I can share that down trends in HY lead to down trends in the stock market, which lead to down trends in the economy. The really big investment mistakes come during economic recessions, so it is important from a money management perspective to avoid the big dislocations that recessions tend to bring.

This first chart plots the price trend of a large and popular high yield mutual fund. The solid green line is a simple 50-day moving average price line. The idea is to invest when the price trend is up (above the green line) and move to Treasurys or cash when the price trend is down (below the green line). In particular, focus in on 2000-2001 and 2007-2009.

<center><img src="[www.cmgwealth.com]; width="800" height="500"></img>

Source: StockCharts.com</center>

While not all crosses work, a number of false signals, the end result is worth the effort. The most meaningful signals occur when price is far above trend (today’s condition) or far below trend (tomorrow’s next great opportunity).

Now, where I think we can really zero in on timing is to combine what price is telling us (above data) with lending conditions. When the lending conditions turn from “Favorable” to “Unfavorable,” that’s when high risk borrowers default. Or as Warren Buffett says, when the tide goes out we’ll see who’s swimming naked. And this time around a lot of swimmers have left their swimsuits on the beach.

Here is how you read the chart:

Note the three red down arrows. They mark the times when the NDR Credit Conditions Index dropped below a reading of 50 (horizontal green dotted line in the lower section of the chart).

- The grey bars indicate periods of recession.

- Finally, note the green “We are Here” arrow.

- Bottom line: Nothing to worry about at this moment.

<center>

</center>

</center>With both HY in an uptrend and lending conditions “Favorable” do go into the weekend with ease and take comfort in knowing there are things you can do to cover your backside.

As you’ll see in the next section, the Trade Signals remain green...'

- Steve Blumenthal, The Slow Squeeze, November 8, 2019

Context

'.."omnipotent central banks" .. create huge distortions..'

Extraordinary Monetary Disorder - 'I have that same uncomfortable feeling I had in 2007 – just a lot worse..'