'..since Irving Fisher first came up with the disastrous “price stabilization” idea..'

Posted by archive

'Since the playbook of monetary authorities has in essence been the same since Irving Fisher first came up with the disastrous “price stabilization” idea, we must expect that little will change. As soon as asset prices decline sufficiently and recent economic weakness intensifies further, it will be back to square one.'

<blockquote>'Roger Garrison, ever the gentleman, refers to the Keynesian model as “labor-based macroeconomics” (see his book “Time and Money” – pdf for details). We are usually less gentlemanly and tend to refer to it as “utter bunkum”. However, Mr. Garrison is not wrong – Keynes and his disciples are uniquely focused on employment, and there is one major trick in their book: inflate and inflate and inflate, so as to lower the real wages of workers. It is held that this will create “full employment” and won’t be resisted as much by workers as the nominal wage adjustments one might expect a free market to deliver when a bust plays out.

This view should have been thoroughly discredited by the events of the 1970s, but as you can see, the planners haven’t really learned anything from that episode – except for coming to the (almost certainly wrong) conclusion that they will be capable to “stop inflation at any time”.

What they don’t mention: the reason why we have such huge boom-bust cycles is precisely that they are inflating all the time. Prior to the Fed implementing its “scientific” monetary policy (which is really “intervention based on the atrociously bad guesses of some of the worst forecasters on the planet”), economic busts were actually more frequent. Fractionally reserved banks tended to bring credit expansions to an end much sooner voluntarily without a “lender of last resort” backstopping them all the way.

The overall long term effect was one of remarkable economic stability. Although credit expansion by private banks still engendered boom-bust cycles, these were far milder and usually self-corrected quite quickly. It took the Federal Reserve to produce events like the Great Depression and the Great Financial Crisis. No dislocations of similar impact had ever been encountered before it was decided that we needed central economic planning and the “stabilizers” took over.

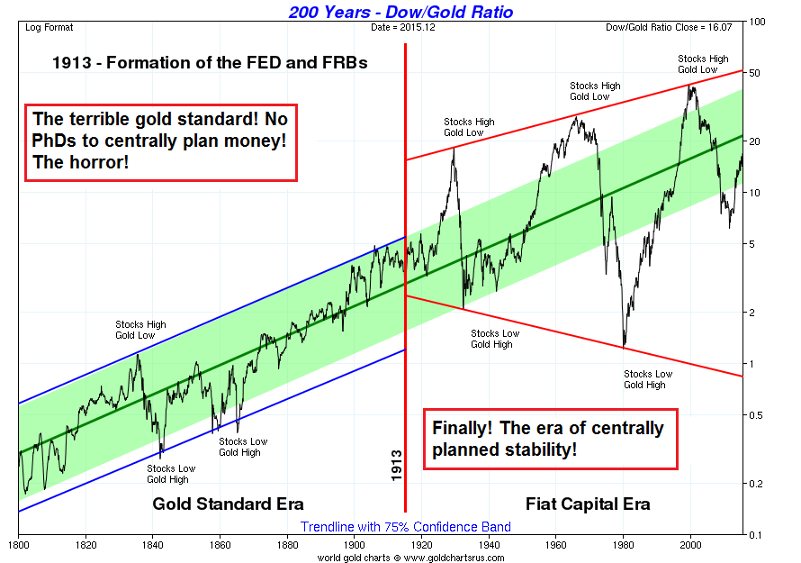

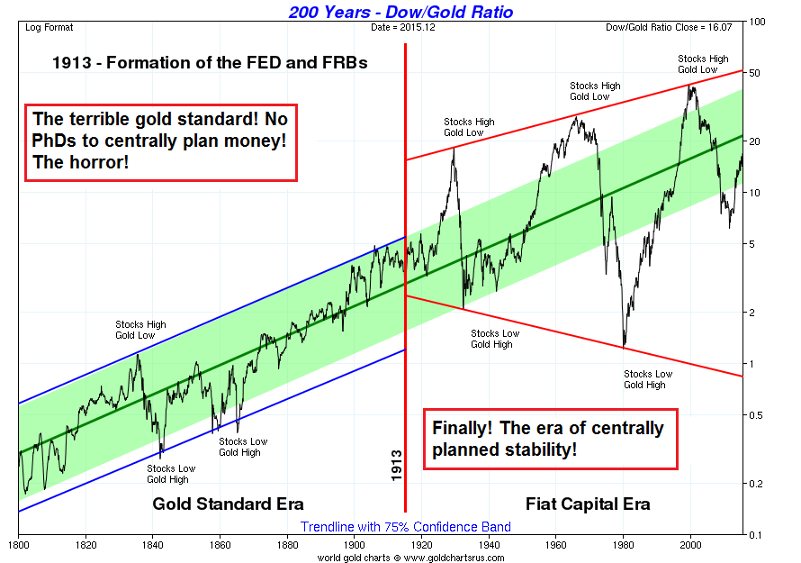

Here is a chart we have shown in a recent Bill Bonner missive that illustrates the above nicely – namely the Dow-gold ratio:

<center>

The difference between a reasonably unhampered free market economy and a severely hampered one steered by monetary centrally planning, as illustrated by the Dow-gold ratio</center>

Conclusion

The rate hike was indeed mainly implemented due to the decline in the official U3 unemployment rate. The Fed’s mandate enjoins it to produce “maximum employment” and “price stability”. Never mind that unemployment really stands around 10% if one counts all the people that have simply fallen out of the statistics (they are represented in the U6 unemployment rate). They certainly have no work, but are nevertheless officially no longer regarded as “unemployed”.

With respect to price indexes, FOMC participants are likely correct in suspecting that they are going to show faster growth rates next year due to base effects. What they apparently don’t see – but will find out soon enough – is that once a major long term bubble bursts, the economy gets zombified if its attempt to correct is arrested by even more intervention.

This phenomenon could be observed in Japan over the past 26 years. Instead of taking the short term pain and allowing all malinvested capital to be liquidated, Japan’s policymakers decided to deficit spend and print out the wazoo – precisely what has been done in he US in the wake of the 2008 crisis. By trying to reverse corrective market processes, they have ultimately produced the so-called “lost decades”.

Since the playbook of monetary authorities has in essence been the same since Irving Fisher first came up with the disastrous “price stabilization” idea, we must expect that little will change. As soon as asset prices decline sufficiently and recent economic weakness intensifies further, it will be back to square one.

Lastly, we are not saying that things will play out exactly in the US as they have in Japan. There are many things that suggest that the situation will develop differently, at least to some extent. The common denominator is only this: central planning and unrestrained fiat money have created such a huge credit boom that the economy’s pool of real funding has been severely undermined.

Once this happens, it is no longer even possible to create the faux prosperity of a boom to a similar extent as previously by simply printing money. As soon as monetary pumping slows down sufficiently, the bust will tend to return with a vengeance. We strongly suspect that Ms. Yellen and her colleagues will learn this part of the lesson next. Or let us rather say: they aren’t going to learn anything from it – but they will undoubtedly face another “no-one could have seen it coming” scenario. We can’t wait to see what their encore will be when that happens.'

- Acting Man, The FOMC Decision, US Money Supply and the Economy, December 18, 2015</blockquote>

Context

<blockquote>'..without taking any care to reduce the size of its balance sheet, the Federal Reserve instantly changed the monetary environment..'

' “Monetary policy… after all, is extremely important” – is an understatement.' - Doug Noland

'..The Coming Loss of Faith in Central Banks'</blockquote>

<blockquote>'Roger Garrison, ever the gentleman, refers to the Keynesian model as “labor-based macroeconomics” (see his book “Time and Money” – pdf for details). We are usually less gentlemanly and tend to refer to it as “utter bunkum”. However, Mr. Garrison is not wrong – Keynes and his disciples are uniquely focused on employment, and there is one major trick in their book: inflate and inflate and inflate, so as to lower the real wages of workers. It is held that this will create “full employment” and won’t be resisted as much by workers as the nominal wage adjustments one might expect a free market to deliver when a bust plays out.

This view should have been thoroughly discredited by the events of the 1970s, but as you can see, the planners haven’t really learned anything from that episode – except for coming to the (almost certainly wrong) conclusion that they will be capable to “stop inflation at any time”.

What they don’t mention: the reason why we have such huge boom-bust cycles is precisely that they are inflating all the time. Prior to the Fed implementing its “scientific” monetary policy (which is really “intervention based on the atrociously bad guesses of some of the worst forecasters on the planet”), economic busts were actually more frequent. Fractionally reserved banks tended to bring credit expansions to an end much sooner voluntarily without a “lender of last resort” backstopping them all the way.

The overall long term effect was one of remarkable economic stability. Although credit expansion by private banks still engendered boom-bust cycles, these were far milder and usually self-corrected quite quickly. It took the Federal Reserve to produce events like the Great Depression and the Great Financial Crisis. No dislocations of similar impact had ever been encountered before it was decided that we needed central economic planning and the “stabilizers” took over.

Here is a chart we have shown in a recent Bill Bonner missive that illustrates the above nicely – namely the Dow-gold ratio:

<center>

The difference between a reasonably unhampered free market economy and a severely hampered one steered by monetary centrally planning, as illustrated by the Dow-gold ratio</center>

Conclusion

The rate hike was indeed mainly implemented due to the decline in the official U3 unemployment rate. The Fed’s mandate enjoins it to produce “maximum employment” and “price stability”. Never mind that unemployment really stands around 10% if one counts all the people that have simply fallen out of the statistics (they are represented in the U6 unemployment rate). They certainly have no work, but are nevertheless officially no longer regarded as “unemployed”.

With respect to price indexes, FOMC participants are likely correct in suspecting that they are going to show faster growth rates next year due to base effects. What they apparently don’t see – but will find out soon enough – is that once a major long term bubble bursts, the economy gets zombified if its attempt to correct is arrested by even more intervention.

This phenomenon could be observed in Japan over the past 26 years. Instead of taking the short term pain and allowing all malinvested capital to be liquidated, Japan’s policymakers decided to deficit spend and print out the wazoo – precisely what has been done in he US in the wake of the 2008 crisis. By trying to reverse corrective market processes, they have ultimately produced the so-called “lost decades”.

Since the playbook of monetary authorities has in essence been the same since Irving Fisher first came up with the disastrous “price stabilization” idea, we must expect that little will change. As soon as asset prices decline sufficiently and recent economic weakness intensifies further, it will be back to square one.

Lastly, we are not saying that things will play out exactly in the US as they have in Japan. There are many things that suggest that the situation will develop differently, at least to some extent. The common denominator is only this: central planning and unrestrained fiat money have created such a huge credit boom that the economy’s pool of real funding has been severely undermined.

Once this happens, it is no longer even possible to create the faux prosperity of a boom to a similar extent as previously by simply printing money. As soon as monetary pumping slows down sufficiently, the bust will tend to return with a vengeance. We strongly suspect that Ms. Yellen and her colleagues will learn this part of the lesson next. Or let us rather say: they aren’t going to learn anything from it – but they will undoubtedly face another “no-one could have seen it coming” scenario. We can’t wait to see what their encore will be when that happens.'

- Acting Man, The FOMC Decision, US Money Supply and the Economy, December 18, 2015</blockquote>

Context

<blockquote>'..without taking any care to reduce the size of its balance sheet, the Federal Reserve instantly changed the monetary environment..'

' “Monetary policy… after all, is extremely important” – is an understatement.' - Doug Noland

'..The Coming Loss of Faith in Central Banks'</blockquote>